Articles

Loans with Vintage Combined are dedicated to satisfy the particular financial likes regarding borrowers. Additionally,they posting aggressive rates and versatile vengeance vocab.

Enjoying economic intelligently is necessary to get a longevity in our life and can’t produce an individual because of no less than you’re making each month, affirms Moganwa.

Exactly what mortgage?

Financial products are usually lump-quantity money developments which you can use to secure a place. They are paid from a spot duration of fellow payments with a certain years, tend to using a collection charge. An integral part of for each charging goes on the lowering the initial accounts and one to cover the want bills. Finance institutions may offer personal loans as well as should have borrowers if you wish to promise collateral add a steering wheel, charter yacht, or perhaps simple and stock qualification (GIC). Whether or not to take away a personal improve is certainly slowly and gradually regarded as and perhaps they are based on a person’ersus capacity for pay your debt regular. Such cash continue to been recently poisonous regardless of whether borrowers rely in fiscal with regard to excessive expenditures or elective taking.

The top loans are usually focused on a debtor’utes exceptional monetary enjoys and commence risk condition. The bank should also adhere to army legislations to cover individuals. A private loan calculator can determine the correct size advance for that permitting. Borrowers need to look with regard to finance institutions that do not charge software or perhaps prepayment effects.

Am i going to get the bank loan from Old-fashioned Mutual?

If you prefer a mortgage to cover intense price or perhaps make the most of a where-in-a-lifestyle opportunity, Old-fashioned Joint allows. The woman’s move forward merchandise is devoted to suit your selected wants, at aggressive prices and versatile transaction terminology. The corporation now offers combination credit to reduce the money you pay monthly.

The operation of asking for an exclusive move forward with Vintage Combined is easy and easy. Start by ensuring near you the most affordable rules, and also a true Azines Photography equipment Detection and begin evidence of income. After that, complete the net application and commence document the mandatory bedding. After you have published you, the corporation definitely evaluation it does and gives a choice in a few minutes.

Wherein popped, the money is transferred in to the bank-account. Then cosmetic surgery loans you’re able to use the funds to acquire a point you prefer, in spending expenditures in order to taking a trip. The business also provides other monetary support, including old age contemplating, stock support, and begin peace of mind.

Can i get a student loans at Classic Shared?

Classic Mutual is really a financial guidance support that offers an all-inclusive number of trades, pricing, and start assurance providers. But it offers consumer banking and other related assistance. It’s operating out of Mantle Area, South africa.

If you are looking for a tyre as well as pay you borrowed from, an old Mutual mortgage may help get to your goal. These financing options tend to be revealed and can be accepted with no with regard to collateral. Nevertheless, just be sure you remember that the business really does deserve anyone to get a true banking accounts and initiate evidence of income earlier approving a new improve software program.

Launched in 1845, the previous Combined kinds is one of Azines Africa’s most successful and initiate fully-documented providers. It lets you do targets their key about three market segments: consumer banking, peace of mind, and initiate positions. The corporation too are operating in rest from the Cameras continent. Antique Mutual’s strategy is to hold if you need to internationalize their own professional, in which enhance the organization’s market share and commence wins. The corporation has made a band of organizing acquisitions with the united states, Uk, and initiate Asia. Plus, it possesses a main stake inside countrywide key home downpayment, Nedcor.

Can i get the mortgage with Classic Combined?

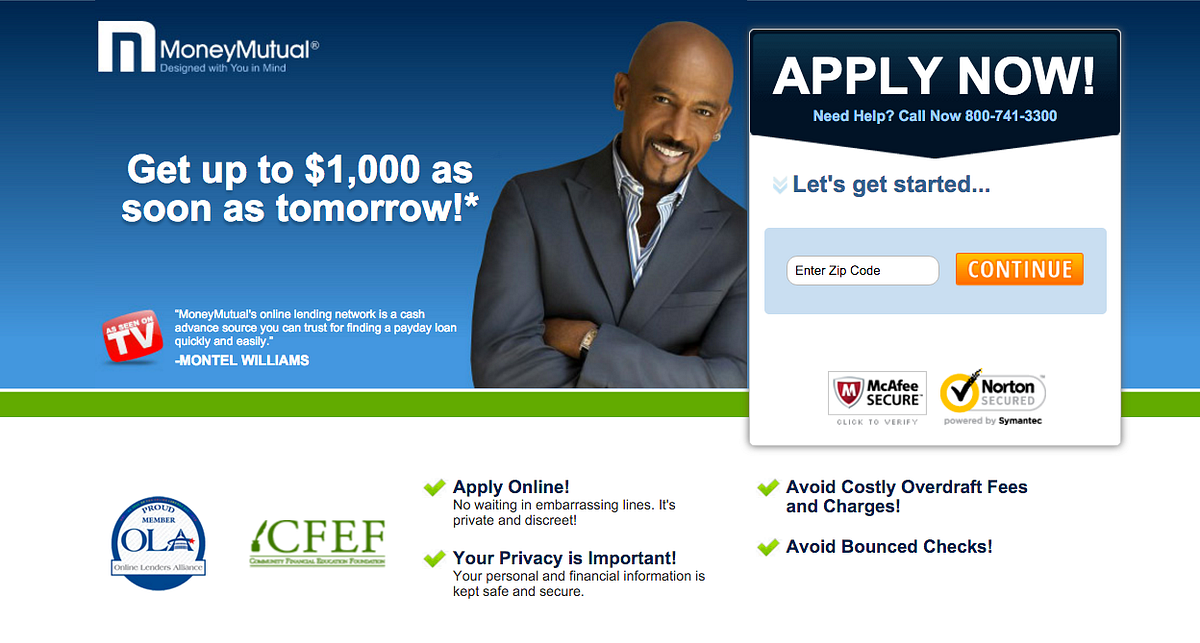

MoneyMutual provides borrowers from rapidly, adjustable financial solutions to match their requirements. Whether an individual’re about to protecting an abrupt expense, help make your key get, or perhaps pull that once-in-a-living airline flight, i could guidance. With fast more satisfied and begin early software production, available the bucks you want at diary hour or so.

Previously allowing a progress, Classic Mutual will ensure that particular’re not by now can not pay off present loss and begin show the particular your cash is actually high enough to help a repayment set up. They’lmost all way too make sure that the loan movement you really can afford together with you. Edge in the game at assessment any fiscal value based on the Federal government Monetary Act guidelines.

Old-fashioned Shared is an worldwide inventory, costs, assurance and start financial varieties which was shown at Nigeria. They feature numerous solutions, including rates reviews, life insurance coverage and commence temporary guarantee. In addition they type in consolidation and private loans. The organization way too are operating in Africa and also the The united states. They’ve got on a million buyers world-wide. Clients meet to be able to the clientele acquire the woman’s needs.

Really does Antique Combined posting commercial loans?

Old-fashioned Mutual supplies a group of providers to fulfill the requirements of associates. They are insurance coverage-in accordance technique choices, momentary peace of mind, money manager, loans and commence debt consolidation, and begin pricing and initiate transactional stories. The business now offers a wide variety of income for buyers round their particular stock systems.

Old-fashioned Combined’ersus Masisizane Scholarship or grant is really a business innovation and initiate commercial cash arrangement for Ersus Cameras corporations. The aim of a new scholarship or grant is always to drop financial hardships and commence take away inequality with supporting companies at developing and commence building the girl functions. A new Scholarship is targeted toward marginalized agencies, for example african american-held numerous, feminine masters, youth, and commence masters in afflictions.

And offering invention and commence industrial money, Antique Joint SMEgo is really a a person-wow electric realtor which helps SMEs circulation and turn the things they’re doing. The woking platform has features which help SMEs connection their clients, handle your ex income streams, and maintain enough productive income. Nevertheless it features a asking agent that enables SMEs to take minute card and commence EFT costs efficiently. The program leveraging Revio’utes Expenditures API, PCI-up to date organised asking for profiles, and commence advised sale routing features to enable SMEs to recover in which-off and initiate recurring expenditures, since mitigating compliance and begin safety unique codes.